War in Ukraine - What should you put on your radar?

The Russian invasion of Ukraine and the ensuing escalation of events have increased the risks to the global economy. It should be noted that before the invasion, the world economy was showing some warning signs, notably with a high inflation rate. In fact, the change in the core consumer price index between February 2021 and February 2022 was 7.9% in the United States and 5.7% in Canada, levels not seen for several decades.

Since the invasion, several economic sanctions have been imposed on Russia, and these could exacerbate the rate of inflation. In order to understand the magnitude of the risks to the global economy, it is worth analyzing Russia's shares of a few key global exports, as shown in the following table:

Table 1 : Russian exports in % of world exports

Source : https://oec.world/

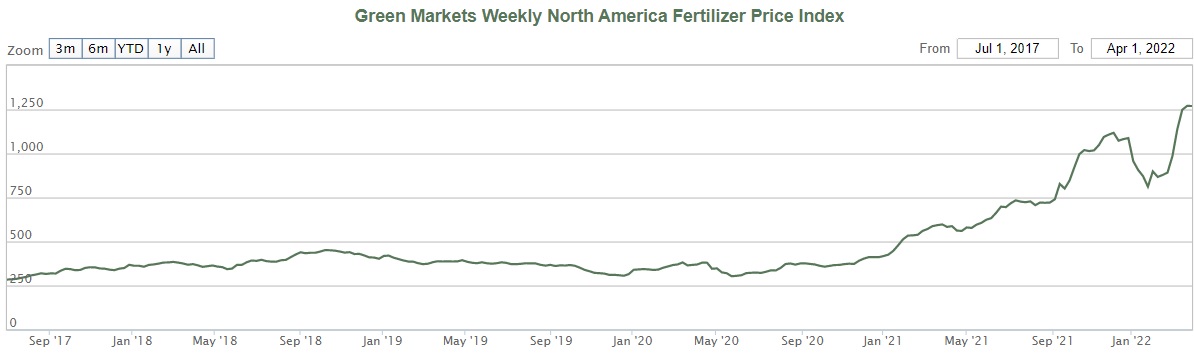

Of particular significance, it can be noted that Russia is a major fertilizer exporter. Fertilizer is an essential commodity and could have a material impact on farmers' production costs and ultimately on the price of food. The following graph shows the evolution of the price of fertilizer over the past years:

Graph 1 : Evolution of the price of fertilizer1 over the past years

Source : https://fertilizerpricing.com/priceindex/

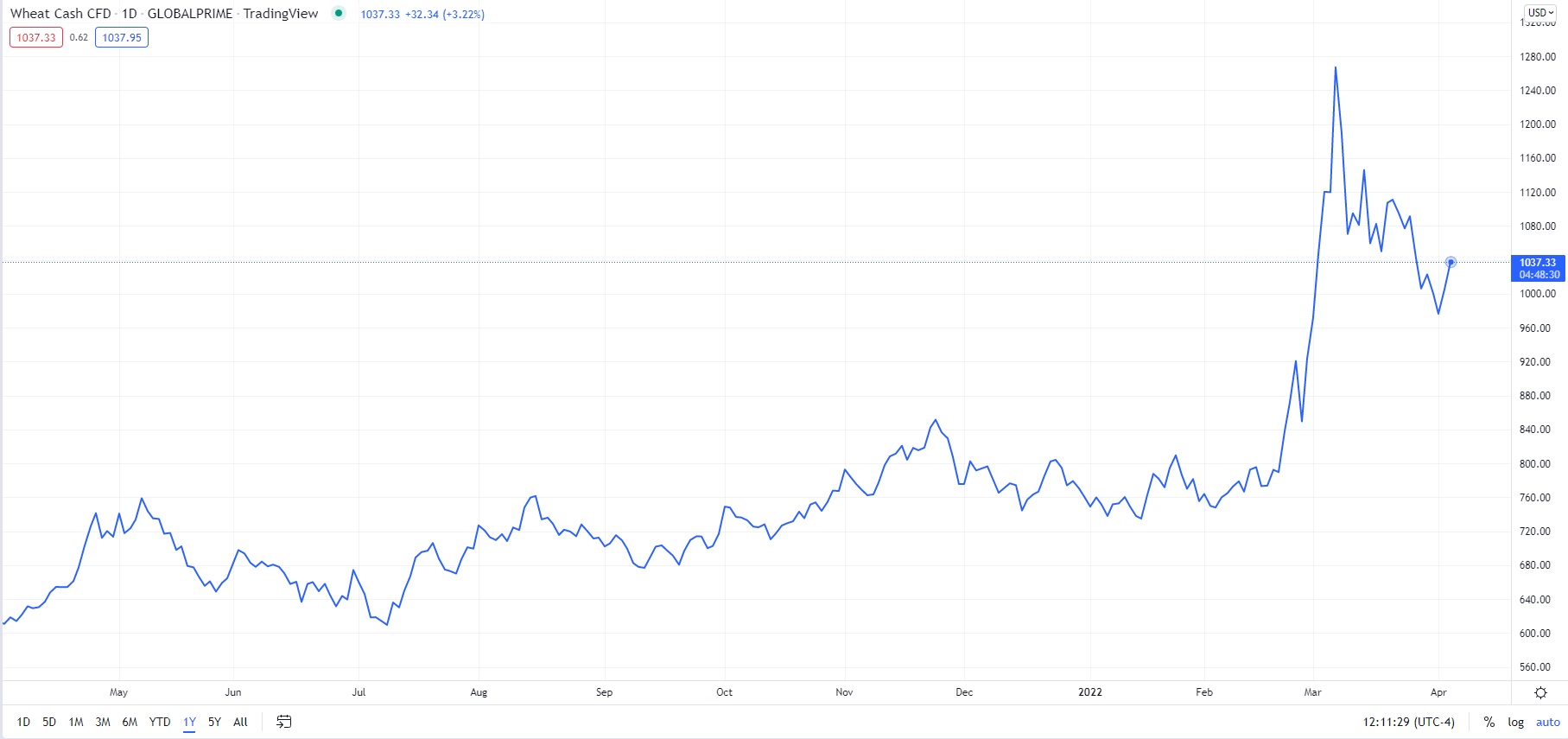

Furthermore, Russia and Ukraine export around 25% of the world’s wheat. Naturally, the war caused the price of wheat to rise sharply, as shown in the following graph:

Graph 2 : Evolution of the price of wheat2 over the past year

Source : TradingView

Another important aspect to emphasize from an economic perspective is that the European Union (EU) is very much at risk given it imports several essential products from Russia, prominently about 40% of its natural gas consumption and approximately 25% of its crude oil consumption. This highlights a crucial problem in that the EU is not energy independent, which certainly gives geopolitical weight to Russia.

It is also worth mentioning that the economic sanctions came mainly from Western countries. The East, specifically China, remained neutral in response to the conflict. It will be especially important to monitor the economic alliances that could be formed following this conflict. The resulting consequences could be significant.

Finally, the beginning of the year has been volatile thus far in the financial markets. The SAI Balanced Fund Index, composed of 40% Canadian Universe Bonds (FTSE Canada Universe Bond Index), 30% Canadian Equities (S&P TSX Composite Index) and 30% Global Equities (FTSE Canada MSCI World $ CAD) posted a return of -3.51% as of March 31.

In our opinion, recent events have emphasized the importance of having a well-diversified pension fund to efficiently deal with the many risks present in the financial markets. Lastly, the current context should encourage trustees and pension committee members to obtain sufficient information from their investment consultant on the impact of the war in Ukraine and of the rising inflation on their pension fund investments.

1 Price of fertilizer represented by Green Markets Weekly North American Fertilizer Price Index.

2 Price according to the difference between the opening and closing of cash settlement contracts.