Draft regulation modifying locked-in assets from certain retirement vehicles

On December 27, the Quebec government published a draft regulation aimed at increasing the flexibility of withdrawals from life income funds (LIF) and considerably reducing locked in assets saved in capital accumulation retirement vehicles and this particularly for people aged over 55. This draft regulation falls within the context of the Act respecting the implementation of certain provisions of the budget speech of March 22, 2022, and modifying other legislative provisions.

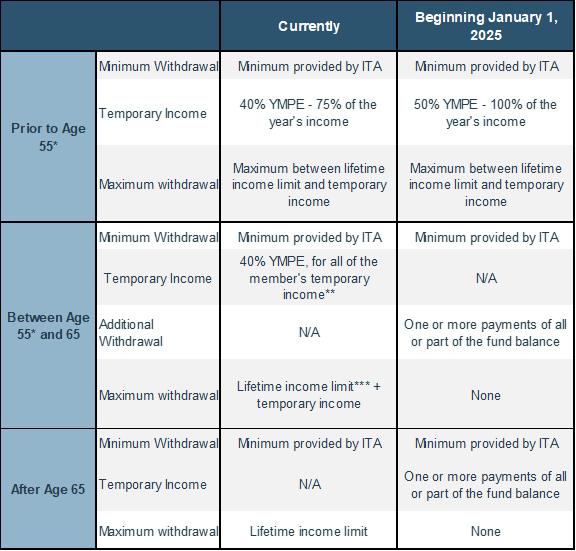

Currently, amounts invested in retirement vehicles such as LIFs are locked in and subject to annual minimum and maximum withdrawals until the person reaches age 95. Additional withdrawals, called temporary income, are, however, permitted before age 65, under certain conditions, up to a maximum of 40% of the year’s maximum pensionable earnings (YMPE).

The proposed regulations modify the maximum withdrawals for a person under the age of 55 and completely eliminate any notion of a maximum limit on withdrawals from age 55. The minimum withdrawal obligations, which are prescribed under the Income Tax Act (ITA) continue to apply.

The LIF owner, aged 55 and over, will now be able to set the amount of income they wish to withdraw from their account each year not withstanding any limits. To help in this decision, the custodian of the LIF must provide them, based on the balance of the fund they hold at the start of the fiscal year, with the life annuity that could be paid to them until they reach the age 95. The estimated amount of the life annuity could also be established by the institution offering the LIF according to the regulations which govern the financial sector’s code of conduct to which it belongs. This annuity is only provided as an estimate. The owner will now be able to request at any time the payment of an additional amount or series of amounts of all or part of the fund balance. A new life annuity estimate will then be provided to the LIF owner to take into account these additional withdrawals.

Contrary to what is provided for in current regulations, it will no longer be possible to transfer amounts from the LIF to an RRSP or RRIF. Such an approach is no longer necessary given the unlocking of assets in the LIF from the age of 55.

These new rules also apply to defined contribution pension plans which provide for variable benefit payments from the plan. The pension committee must ensure that members are well informed of these new withdrawal opportunities but also of the impact on their future income. Pension committees will also have to measure the impact of these withdrawal possibilities on the need for liquidity of their defined contribution plan.

The following table summarizes the changes.

* In the current regulations, and for certain retirement vehicles, including LIFs, the line between section 1 and 2 is made for members who

are under 54 at the end of the previous year and not for those under 55 years.

** Temporary income may be less if the account balance is below a certain level prescribed by the regulation.

*** Lifetime income limit adjusted to take into account the temporary income taken.

The lifetime income limit corresponds to the account balance multiplied by a factor, which is determined in accordance with the rules prescribed in the regulations of the Supplemental Pension Plan (SPP) Act. The draft regulation modifies the formula for calculating this factor.

The concept of life annuity estimation which appears in the draft regulation does not exist in the current regulation. This estimate of life annuity should not be confused with the life income limit which is present in the current regulation, and which will remain applicable before age 55. The rules used to determine the estimate of the life annuity are not the same as those used to determine the life income limit before age 55.

Defined Benefit Plan

For defined benefit plans that allow the transfer of the value of benefits to a LIF upon the member's retirement, these transfers will automatically be subject to the new regulations. Sponsors of defined benefit plans, particularly those offering transfer at retirement, will have to evaluate the impact of this new option, which no longer allows the assets accumulated in supplemental retirement plans to be locked in.

Effective Date

This regulation comes into force on January 1, 2025, with the exemption of the provisions concerning the elimination of maximum withdrawals from age 55 in LIFs and defined contribution plans offering variable benefits which come into force on July 1, 2024. In this regard, LIF promoters and pension committees must inform without delay in 2024 LIF owners and members benefiting from variable benefits over the age of 55 or reaching this age during the year 2024 of the new withdrawal options applicable to the year 2024.

Conclusion

If these new provisions are adopted, it will be very important to communicate with LIF owners as well as with members who receive variable benefits in defined contribution plans to inform them of the significant impact that additional withdrawals could have in their funds. Withdrawals should be part of financial planning that considers all retirement income including the retirement pension from the Quebec Pension Plan and the Old Age Security Pension at the risk that the members could find themselves short of money, well before reaching the age of 95.