The Québec Pension Plan – Actuarial Valuation as at December 31, 2021 and Public Consultation

On December 9, 2022, Mr. Éric Girard, the Government of Quebec’s Minister of Finances, tabled at the National Assembly, in accordance with section 216 of the Act respecting the Québec Pension Plan (“QPP Act”), the Québec Pension Plan’s actuarial valuation report as at December 31, 20211. This valuation must be produced at least triennially. The previous valuation was completed as at December 31, 2018.

On the same occasion, a consultation document entitled "A Plan adapted to the Challenges of the 21st century"2 was also tabled as part of a public consultation provided for in section 218.1 of the QPP Act, which must be carried out at least once every six years. This document initiates a reflection by proposing changes to the Québec Pension Plan “QPP” regarding both the Base Plan and the Additional Plan.

The QPP offers all individuals over the age of 18 who work in Quebec, as well as their loved ones, basic financial protection in the event of retirement, death or disability. It is composed of two plans, namely the Base Plan and the Additional Plan. Overall, the two plans aim to provide retirement pensions, which are payable without reduction at age 65, equivalent to 33.33% of employment earnings up to the Year’s Additional Maximum Pensionable Earnings (YAMPE of $75,900 in 2023). However, a portion of the retirement pensions, those provided for by the Additional Plan, will not be fully paid until after 40 years of contributions3.

In 2021, the Basic Plan, which exists since 1966, paid pensions to 2.0 million beneficiaries totaling $16 billion. Its reserve reached $103 billion on December 31, 2021. The Additional Plan, which has only been in effect since 2019, paid pensions to 200,000 beneficiaries totaling $5 million in 2021. Its reserve reached $3 billion on December 31, 2021.

Actuarial Valuation report as at December 31, 2021

Highlights of the Basic Plan’s funding

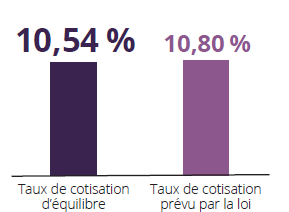

The Basic Plans’ funding is mainly based on contributions (60%). The second funding source comes from investment income on the reserve (40%). The main purpose of the actuarial valuation is to determine the steady-state contribution rate4. In the actuarial valuation as at December 31, 2021, this rate is calculated at 10.54% compared to 10.67% in the previous actuarial valuation. It therefore compares favorably with the contribution rate provided for by the QPP Act of 10.80%, the latter rate being the one on which current contributions are based. A margin of manoeuvre of 0.26% is therefore available and the QPP Act does not provide for any downward adjustment in contributions.

Projections show that cash inflows are sufficient to fund cash disbursements for each of the 50 years projected (2022 to 2071). The ratio between the reserve and disbursements fell from 4.8 as of December 31, 2018 to 6.1 as of December 31, 2021, whereas a ratio of 4.9 was expected. The reserve as of December 31, 2021 is therefore larger than expected, mainly due to $14 billion dollars of investment income higher than anticipated.

The Basic Plan’s financial indicators show that it was in good financial health as of December 31, 2021.

Basic Plan

Source : Rapport de l’évaluation actuarielle du Régime de rentes du Québec au 31 décembre 20211 - Faits saillants

Highlights of the Additional Plan’s funding

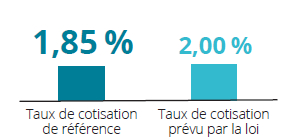

The Additional Plans’ funding is mainly based of investment income on the reserve (70%). The second source of funding comes from contributions (30%). The main objective of the actuarial valuation is to determine the reference contribution rate5. In the actuarial valuation as at December 31, 2021, this rate is calculated at 1.85% compared to 1.84% in the previous actuarial valuation. It therefore compares favorably with the rate provided for by the QPP Act of 2.0%6, the latter rate being the one on which current contributions are based. A margin of manoeuver of 0.15% is therefore available and the QPP Act does not provide for any contribution adjustments prior to 2024.

Projections show that cash inflows are sufficient to fund cash disbursements for each of the 50 years projected (2022 to 2071)7.

The Additional Plan’s financial indicators show that it was in good financial health as of December 31, 2021.

Additional Plan

Source : Rapport de l’évaluation actuarielle du Régime de rentes du Québec au 31 décembre 20211 - Faits saillants

Source : Rapport de l’évaluation actuarielle du Régime de rentes du Québec au 31 décembre 20211 - Faits saillants

Other Observations

The COVID-19 pandemic had a limited effect in the short term. The COVID-19 pandemic has caused episodes of higher and lower mortality in Quebec, especially for beneficiaries. Despite these unusual fluctuations in mortality rates, the long-term life expectancy is comparable to that estimated in the previous actuarial valuation. In addition, the contributions paid were slightly higher than those forecasted in the previous actuarial valuation.

Increased indexation on short-term annuities. The projection provides for pension indexation of 5.8% and 3.4% on January 1, 2023 and January 1, 2024 respectively. These high indexation rates reflect the consumer price indices until May 2022. Pension indexation actually applied on January 1, 2023 was 6.5%.

Retirement pension applications delayed. This observation has been recurrent since 2014, the year from which no condition relating to employment is required to apply for a retirement pension and from which the adjustment factors for early retirement were increased. The proportion of people who request to receive their pension from the plan at age 60 compared to the total number of retired people of the same age has fallen between 2014 and 2021 from 60% to 36% among women and from 56% to 31% among men. In the projection, this decrease continues, but at a slower pace to stabilize as of 2031. Deferring the start of retirement pension payments represents an increase in costs for the QPP. In fact, even if no benefit is paid during the deferral period, the lifetime pension paid will be greater since the deferral period to which the adjustment factors apply is shorter. Since these factors are high, overall disbursements will be higher for the plan, resulting in higher costs.

Primary funding risk factors. For the basic plan, the primary risk factor is the evolution of the payroll subject to contributions. For the Additional Plan, the main risk factor is the investment return on the reserve. However, short term, the Additional Plan’s results are not very sensitive to investment income since the reserve is small in proportion to the contributions.

Uncertainty related to recent events. The QPP’s actuarial valuation as at December 31, 2021 was produced in unprecedented times, namely the COVID-19 pandemic, economic and geopolitical instability and the labor market’s transformation. The uncertainty inherent in the projections, particularly those in the short term, is therefore greater than in the past. However, QPP funding is done with a long-term perspective.

The consultation document

The consultation document presents the good financial health of the Basic Plan and the Additional Plan as an opportunity to make changes that will have an impact on Quebecers financial security of upon retirement, death or in the event of disability.

The consultation document discusses some changes which, according to the author, are aimed at increasing financial security in retirement and others aimed at better recognizing certain life situations that can lead to a reduction in earnings such as a period of disability, a period during which it is necessary to take care of a dependent child and a period of Informal and family caregiver.

Changes which, according to the author, aim to increase financial security

- Deferring by 2 years the minimum age (early retirement age with reduction currently at 60 years old) and the maximum age requirement (maximum postponed retirement age currently at 70 years old) with a gradual implementation over 7 years or the deferring by 5 years the minimum age and the maximum age with a gradual implementation over 22 years;

- Offering QPP pension recipients the possibility to cease contributions at age 65 even while continuing to be within the workforce;

- Modifying the pension calculation method to ensure that years of low earnings after age 65 cannot reduce the average earnings used to calculate the retirement pension

- Increasing the retirement pension adjustment factors during early retirement in order to partially offset the increase in costs related to the other changes discussed. The current adjustment factors vary between 0.5% and 0.6%, depending on QPP retirement pension level, per month of early retirement. They would move to a range of 0.55% to 0.65%.

Changes to recognize special situations

- Adding earning credits to the Additional Plan for periods of disability and periods when it is necessary to take care of a dependent child;

- Recognizing in the Basic Plan and in the Additional Plan periods of Informal and family caregiver.

The effect of the changes discussed on the basic plan’s contribution rate would almost certainly completely eliminate the margin of manoeuvre of 0.26% of pensionable earnings identified in the actuarial valuation as at December 31, 2021 or partially eliminate the latter if the adjustment factors for early retirement are modified. The effect of these changes on the reference contribution rate of the Additional Plan is proportionately less significant. It should be noted, however, that the effect on the modifications aimed at recognizing specific situations has not been quantified.

Finally, the consultation document provides a reminder of the automatic adjustment mechanisms in place in the event of a poorer financial health. It reminds that if the contribution rate to the Basic Plan is 0.1% or more higher than the contribution rate provided for by the QPP Act, then the latter will be increased annually by 0.1%. It also mentions that the benefits and contributions could be modified in the event of financial imbalance in the Additional Plan, but that the parameters of this adjustment mechanism have not yet been defined.

The public consultation on the QPP should be held quickly at the beginning of 2023. Individuals and groups who wish to do so can submit briefs to the Commission directing this consultation.

We invite you to contact your SAI Consultant for more information about this publication.

2https://www.retraitequebec.gouv.qc.ca/SiteCollectionDocuments/RetraiteQuebec/fr/publications/nos-programmes/regime-de-rentes/consultation-publique/1602f-consultation-publique-regime-adapte-defis-21e-siecle.pdf

3 Contributions to the Additional Plan began on January 1, 2019 for component 1 and will begin on January 1, 2024 for component 2. For more details on the benefits of the Plan. For additional information you, refer to https://www.rrq.gouv.qc.ca/en/programmes/regime_rentes/Pages/bonification-du-rrq.aspx

4 The steady-state contribution rate is the lowest rate that will allow the Basic Plan to maintain a constant ratio between the reserve and the annual benefits paid.

5 The reference contribution rate for the Additional Plan is the lowest contribution rate that will allow, at the end of the twentieth projected year, an accumulated reserve of at least equal value of expenses subsequent to this twentieth year relating to the contributions paid before the end of this same twenty-year period.

6 The contribution rate provided for in the QPP Act for funding of component 2 of the Additional Plan is four times that of component 1, i.e. 8%. This will apply to earnings above the YMPE ($66,600 in 2023), up to 7% of the YMPE in 2024 and up to the difference between the YMPE and the YAMPE thereafter.

7 The forecasted reserve at the end of the twentieth year projected (2041) according to the contribution rates provided for by the QPP Act is $169.1 billion, which is greater than the $156.5 billion value at that time of the benefits relating to the years prior to 2042.